“Not your keys, not your crypto.” “Don’t trust, verify.” These are fundamental rules we live by in crypto, but it seems some of us have lost our way—or never got the message in the first place. After the recent debacle at FTX, many cryptocurrency investors are understandably shaken to the core. As a result, self-custody is becoming more popular than ever before.

The first step to becoming self-custodial is moving funds off of centralized exchanges. But did you know that there are *decentralized* exchanges? A crypto exchange owned by NO ONE? But how? In this post we’ll be going over what exactly a centralized exchange is, what a decentralized exchange is, how they work, and the pros/cons of each!

Centralized exchanges (CEXes) are comparable to a traditional bank—they keep your assets in their accounts, and you have to trust that they're keeping your crypto safe for you. In theory, you are able to withdraw your funds at any time, but that isn’t always the case, as we’ve unfortunately seen time and time again.

The exchange may or may not be misappropriating your funds. They may or may not be running on a fractional reserve model and secretly be insolvent (looking at you FTX 👀). The “fractional reserve model” is when a financial entity (usually a bank) only holds a fraction of their customers' accumulative funds at a time. They use the rest of the funds to generate returns. In traditional finance this is common practice and massive bank failures are (thankfully) rare. But as we’ve seen time and time again, CEXes that adopt this model are less resilient.

At the moment, CEXes are typically seen as the simpler option compared to DEXes, due to the ease of onboarding and the kind of customer support that users expect from banks. CEXes are also supposed to be regulated in order to comply with local/federal laws and ultimately protect users, although current regulations around crypto seem to be vague at best.

Decentralized exchanges (DEXes) work differently, replacing what would traditionally be a central authority with smart contracts. These smart contracts allow two parties to enter into an agreement, similar to a legal contract, except enforced by code rather than law. If both parties do what is agreed upon, and nobody tries to pull anything fishy, the transaction will go through. Otherwise, the smart contract denies it and the transaction fails. This process eliminates the need for trust altogether, removing any anxiety that the DEX you’re using might block transactions, or even worse - misplace your funds! Since a DEX allows you to make trades without taking custody of your funds, your crypto stays in your non-custodial wallet and you never lose access to it.

Whether you prefer the convenience of a CEX or the security of a DEX, you should know at least a little about how they operate under the hood. There are two main trading systems that exchanges use.

First is the “Order Book Method”. In this method, you simply pick the price you want to buy or sell an asset at, the smart contract or CEX takes your funds, and when it finds someone who wants to perform the exact trade that you’re offering - it executes the trade.

The second trading system, called “Automated Market Making” or “AMM” for short, is exclusive to DEXes and is the preferred method for most DEXes as well. Instead of waiting to find someone to trade with, you’re trading with a pool of assets (called liquidity pools, or LPs) funded collectively by the community. With each token that you buy from any liquidity pool, the price of that token gradually increases. The less tokens are left in the pool, the more it charges. The opposite is true for selling - the more tokens are being sold, the lower the price. The AMM algorithm incentivizes traders to even out unbalanced pools in order to profit off of the opposite trades. Typically, any fees paid go to liquidity providers (the community of people funding the liquidity pools), creating an efficient, incentive-based system. Automated market making works amazingly well, and is why most DEXes use it.

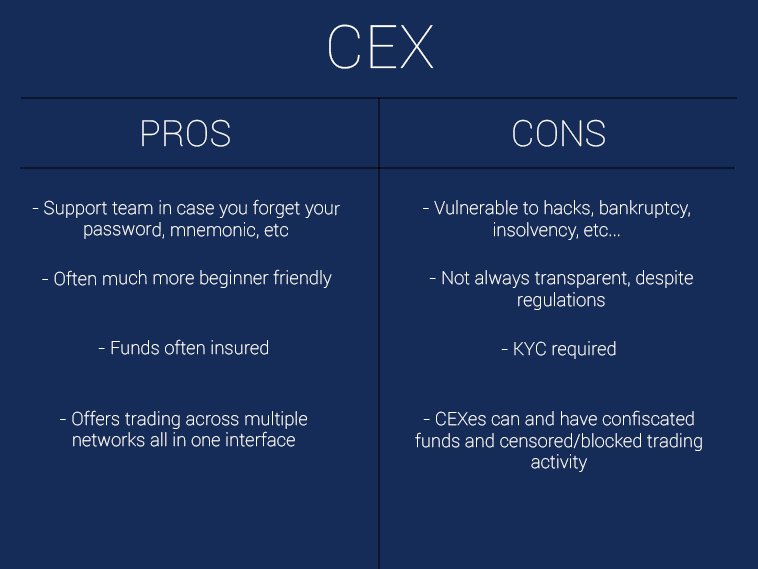

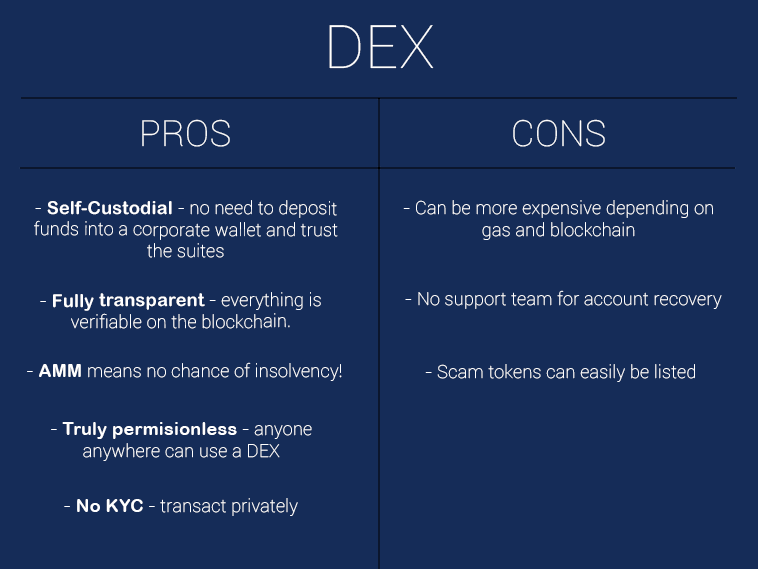

So what are the pros and cons of each? Lay it out for me.

Honestly, each pro/con could have a whole MEWtopia article written about it. But here goes:

Ultimately, centralized and decentralized exchanges can both serve users’ needs. As long as users are aware of the caveats of custodial services and educated about the benefits of self custody, DEXes and CEXes can coexist with non-custodial wallets, multi-sig wallets, and DeFi platforms as valuable tools for crypto users.

If self-custody sounds like something you’re interested in learning more about, check out some of our articles about decentralization, self-custody, web3, and all the crypto things! We’ve been building for a more decentralized industry since 2015 and we aren’t stopping anytime soon. Through the chaos, the future of finance is truly exciting. And MEW is here for it.